Personal Cybersecurity Habits You’re Overlooking

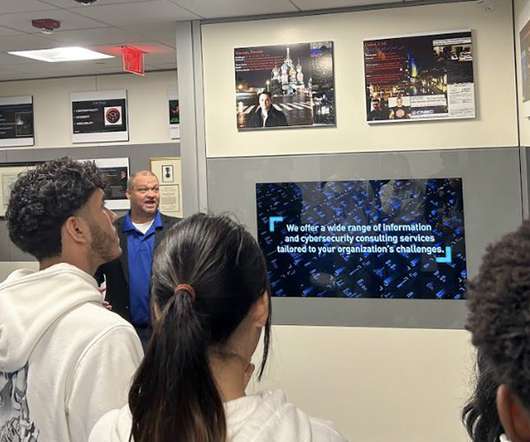

Withum

JANUARY 23, 2023

As users or end-users in IT terms, we often receive notices and trainings to keep our company and client data safe. These tips are always helpful, yet the information does not readily translate to personal cybersecurity diligence. Our accompanying podcast, “Personal Cybersecurity Habits You’re Overlooking,” solicits advice from Withum’s Julie Tracy , Executive Cybersecurity Advisor.

Let's personalize your content